K ENERGY

GROWTH EQUITY FUND

IMPACT AND TECHNOLOGY

Aiming Carbon Mitigation, boosting employment and economic development by incorporating Solar, Wind, SAF, RNG, Ammonia

TERM AND RETURNS

Expected term is around 7 Years with expected returns of 20-25%. During the 7 years significant capital will be distributed from cash flows,

DEAL AND FUND SIZE

Average deal size is $20MM- $75MM and targeting fund ~$300MM

TURNKEY SOLUTION

We are energy infrastructure investors providing a turn key behind the meter power solution to data center for industry

INVESTMENT OPPORTUNITY

K Energy Growth Equity Fund is focused on investments across the sustainable energy sector. We are committed to fostering innovation and implementing viable solutions.

The surge in demand for energy presents an unparalleled opportunity to invest in the creation of sustainable energy.

This nascent sector stands on the cusp of significant evolution and expansive growth. Existing sources of energy and infrastructure is not sufficient to power the demand of the digital and electrified world.

Regulatory requirements for companies and industrial to

diversify their sources of power and reduce their carbon

footprint demands new solutions.

KEY INVESTMENT VEHICLES

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

PROJECTS

INNOVATIVE TECHNOLOGY

DEVELOPERS

INVESTMENT OPPORTUNITY

- Sustainable energy generate outsized returns, driven by favorable energy pricing, additional revenue garnered via the by products created during production, grants and government incentives

- Our model offers a unique edge: invest early at low valuations, actively support growth, and globally integrate technology into projects. We realize returns both at the management and portfolio levels, offering investors short to medium-term dividends with the added upside from management

- We adopt a flexible approach, taking either minority or majority stakes, and positioning as JV partners in the US. The pivotal step is operationalizing the initial plant; after that, growth potential is immense

- The industry model is rapidly shifting and adapting to market demands. Our investments transform from non-revenue to secured cash flows from reputable rated companies. Unlike many software firms, our model swiftly turns into secured profitable cash flows with the ability to scale efficiently

- We maintain a diverse portfolio across varied technologies and sectors, boasting a project pipeline exceeding $10B and partnerships with over 100 off-takers globally

- Our team excels in deep analysis and conservative underwriting, tapping into extensive resources to find lucrative investments. We're active in the Americas and Western Europe, with plants worldwide, providing the capital and know-how for global expansion via our extensive network and trusted engineering, EPC, and development partners

DILIGENCE PROCESS

We meticulously assess and analyze investment opportunities, leaving no stone unturned. Our robust approach ensures informed decision-making and mitigates risks, safeguarding the interests of our investors

Market & Industry Analysis

Evaluate trends, competition, and dynamics. Partner with companies possessing a robust pipeline and capacity to foster long-term relationships with significant off-takers

Financial Analysis

Rigorous underwriting ensures viable and profitable value proposition, with conservative assumptions, independent of government stimulus or grants

Regulatory Review

Conduct thorough due diligence on legal agreements and regulatory compliance. Maintain strong connections with government and grant providers

Investment Objectives

Best-in-class technology and management teams with cost-efficient solutions. Companies possess robust, ready-to-execute pipelines

Risk

Identify, evaluate, and mitigate operational, regulatory, and other risks. Focus on operational viability, technology evolution, and cost competitiveness

Valuation

Ensuring that investments are entering at growth stage to achieve optimal returns and aligning with government and industrial off takers for long term contract 7 to 20 years. Minimum return hurdle is 20% and in current market returns can achieve 50 to 80% returns

Scenario Analysis

Assess resilience under various market and operating conditions

EXECUTIVE SUMMARY

Unique growth opportunity in sustainable energy, driven by global ESG mandates and need to localize energy production

- Sourcing cutting-edge technology

- Partnering with leading developers and operators

- Securing prime brownfield sites or preparing greenfield sites

- De- Risking - insurance protection with New Energy Risk and Munich Re via technology wrappers and development protection. Additional due diligence by third part

- Securing off-takers, Feedstock, and equipment

- Strong relationships with carious EPC providers, Engineering teams, Insurers, and post build operators

- Access to buyers for an investment take out

INVESTMENT STRATEGY

TECHNOLOGY

- Companies with differentiated technology protected by IP and Patents

- Proven technology and ready for commercialization or are commercialized already but lack the capital to scale and grow optimally

- We layer the improved technology into projects we are building

- Risk mitigation by securing insurance to provide technology wrappers and cash flow protection

- We invest in Series A or B, directly in the TopCo and we acquire patents

DEVELOPERS

- We partner with developers with value engineering capabilities

- Negotiate exclusivity and ROFR terms

- Each Developer has an expertise in a specific sector and strong relationships throughout the ecosystem

- Ability to efficiently procure suppliers, equipment and labor

PROJECTS

- Building sustainable energy projects ranging from natural gas, cement, hydrogen, solar, battery storage, wind, biofuels, graphene,to sustainable housing materials, decarbonizing products for industry and brownfield sites

- We layer in advance technologies to projects delivering efficient sustainable energy and decarbonizing solutions

- Obtain rated off takes which maximizes our ability to structure efficient of public and private funding

- Investing in projects as early as Pre NTP and have several exit options available from FID or COD to a few years into operations

- Timing of exits range from 1.5-5 years

- Exit counterparties include: strategics, financial sponsors, insurers, or pensions who are keen to own long-term, stable cash flowing assets or acquire de-risked projects

ADVANTAGES

- Value Engineering - designing bespoke solutions for industrial and large-scale datacenters

- In house expertise to vet technology

- Strong pipeline of projects

- Developers on a regional level

INVESTMENT OPPORTUNITY

- K Energy Growth Equity Fund is focused on investments across the sustainable energy sector. We are committed to fostering innovation and implementing viable solutions.

- The surge in demand for energy presents an unparalleled opportunity to invest in the creation of sustainable energy.

- This nascent sector stands on the cusp of significant evolution and expansive growth. Existing sources of energy and infrastructure is not sufficient to power the demand of the digital and electrified world.

- Sustainable energy generate outsized returns, driven by favorable energy pricing, additional revenue garnered via the by products created during production, grants and government incentives

- Our investments transform from non-revenue to secured cash flows from reputable rated companies, which contributes to our ability to efficiently scale

- We maintain a diverse portfolio across varied technologies and sectors, boasting a project pipeline exceeding $10B and partnerships with over 100 off-takers globally

- Our team excels in deep analysis and conservative underwriting, tapping into extensive networks to find lucrative investments. We're active in the Americas and Western Europe, with plants worldwide, providing the capital and know-how for global expansion via our extensive network and trusted engineering, EPC, and development partners”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

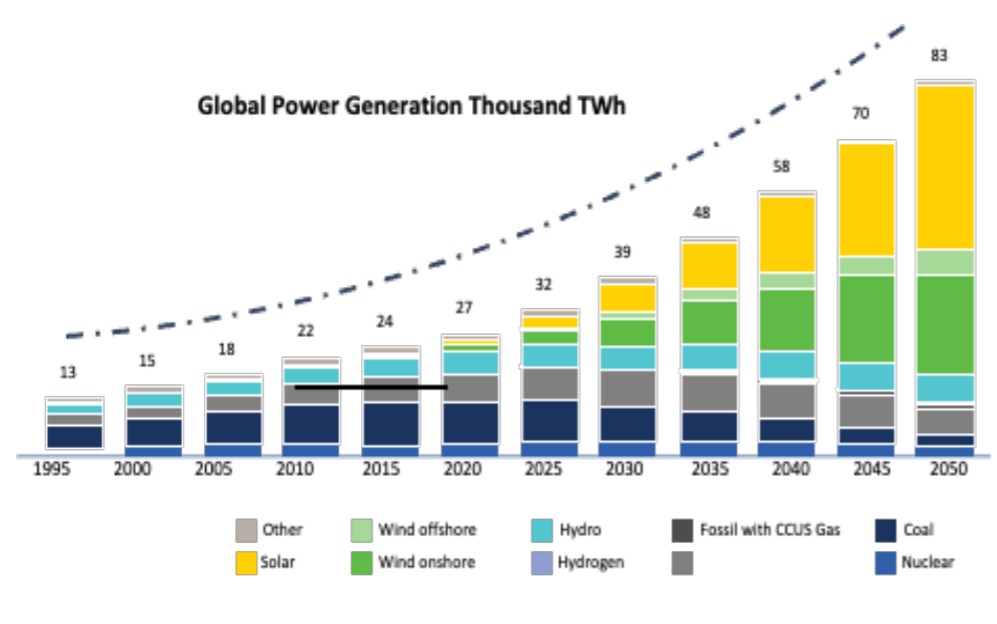

The Sustainable REVOLUTION: POWER GENERATION FORECAST

Renewable energy sources (RES) are projected to lead the power generation mix, reaching 80-90% by 2050

The often neglected 25% of RES growth will come from from emergring hydrogen technologies, bioenergry, hydropower and other solutions

The often neglected 25% of RES growth will come from from emergring hydrogen technologies, bioenergry, hydropower and other solutions

Sustainable Energy Expertise

We leverage our institutional experience to conduct market, industry, regulatory and financial analysis that considers risk, valuation and investment objectives.

Biofuels

Renewable energy derived from organic materials, powering industries from transportation to agriculture

Battery Storage

Advanced energy storage systems that ensure a reliable 24/7 supply of renewable energy.

Green Methanol

Sustainable methanol produced from renewable sources, offering an alternative fuel for shipping and industry

Synthetic Aviation Fuels

Clean, synthetic fuels developed for aviation, enabling low-carbon air travel and reducing industry emissions

Get in touch

Contact our team

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

employee@example.com

+888-2002-234

Appointment

Let's start your project

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

K ENERGY TEAM

KYLE FOX

Founding Partner

OMER JAWAD GHANI

Head of Capital Formation

CHARLES MILLER

CTO

K ENERGY TEAM

Kyle Fox

Founding Partner

Kyle has been investing across debt and equity for over 20 years. Prior to founding KRF Capital and its discretionary growth equity fund, K Energy, she served as the Global Head of Capital Markets at HIG Capital. She founded the team and led over 60 debt financing and sell side mandates globally across their investment strategies including credit, real estate, infrastructure and LBO. She has experience in sourcing and financing deal acquisitions and exits across the corporate, infrastructure, energy, hospitality and real estate sector. She has worked with private and public companies performing several roles including M&A advisor, investor, lender and borrower. Prior to joining HIG Capital, she held roles at companies such as Lloyds Banking Group, Deutsche Bank, and Duff & Phelps.

With her wide network she manages and cultivates capital market relationships across a broad array of institutions. She has lived and worked in Asia, UK and the US. As of late, she has dedicated herself to becoming an expert in new technologies that can help increase revenue and engagement opportunities.

Kyle holds a BA in Political Science and an MBA in finance from Fordham University.

Dave Mirynech

Advisor

Founder and CEO of FanClub, a sports investment and community building platform. He has worked in private equity and sports analytics for teams in the OHL & NHL. Dave was the first employee at MLG Blockchain Capital, a firm that has advised on over £16B in digital asset offerings, and later spent time in venture capital where he led over £16 MM of early-stage crypto/fintech investments.

Dave sits on the advisory board of the Scotia Bank digital-banking lab and collaborates with the Blockchain Research Institute, understanding the intersection between Blockchain & Capital markets. A personable and passionate leader, as well as a critical and strategic thinker with interests in all things business, Sports, Web 3.0, technology, and capital markets, he specifically focuses on sports financing through private equity and equity crowdfunding.

His specialties include – Crypto | NFTs & DAOs | Venture Capital | Digital Securities | Raising Capital | Private Equity | Sports | Alternative Financing.

Dave attended Ivey Business School.

Satish Kutty

CTO

Satish Kutty is backed by 30 years of experience. He spent his early years in research, focusing on Analog Signal Processing and Advanced Microprocessors, at Indian Institute of Science, Bangalore. He continued the pursuit of advanced technology as a scientist with an Electronics Fellowship. He held senior engineering and technical account management roles, as an early member of Server, a chipset startup, which was successfully acquired by Broadcom. His contributions spanned from working on emerging technologies and customer facing roles in multiple divisions at Broadcom. He held a senior management role at Supermicro, aligning emerging technologies and working closely with the CEO and SVP of Technology. His contributions spanned across technical, marketing and business enablement roles for strategic accounts. Prior to Supermicro, he was the marketing and strategy consultant to CMO at Applied Materials. Prior to Applied Materials, he was Vice President of Product and Strategy at Redpine Signals, responsible for strategy, partnerships, channel and customers, to drive revenue growth. It was successfully acquired by Silicon Labs.

He received a Bachelor’s degree in Electronics Engineering from UVCE Bangalore and completed with Honors, an Advanced Microprocessors program from Indian Institute of Science.

Omer Jawad Ghani

Head of Capital Formation:

Omer Ghani has worked at leading fortune 500 firms across NY, London, and the GCC, serving in C-suite positions and managerial roles. He has served in executive positions at companies like Swiss Re, Bear Stearns, J.P.Morgan, and Macquarie Capital. Ghani also co-founded a firm called Old Park Capital. In addition, he has worked as an investment advisor to major corporations such as Unilever, BAT, Glaxo, IBM, Merck, Sanofi Aventis, as well as GCC banks including MCB, HBL, Bank Alfalah, and FWBL. Ghani holds graduate degrees from the University of Pennsylvania and London Business School.

Haroun Sharif

Head of Capital Formation:

Haroun has been an advocate for almost 10 years in litigation and transaction advisory. Represented large corporates in Pakistan including Army Welfare Trust Investments, Nuctech Limited, CMEC, GHCL, Pakistan International Airlines, Al-Haj Energy, and he advised one of Pakistan’s largest hospitality developers, SKY9, leading a Rs. 9bn restructuring of its portfolio. Strong cross border experience across civil corporate disputes, representing clients in various domestic and international arbitrations, anti-corruption defense, securities, and serious fraud litigation. Previously, he was General Counsel at the Special Technology Zone Authority and worked at UBS Investment Bank, London, as an analyst before completing his LL.B. Haroun began his legal work at the Office of the Advocate General Punjab in Lahore as a Research Associate. Mr. Sharif graduated with a B. A from Grinnell College, an LL.B. (Hons.) from the University of London and an MSt from the University of Cambridge. He is proficient in Mandarin, having worked and studied in Beijing. He is enrolled with the Islamabad Bar Council.

Will Fox

Senior Associate:

Experienced analyst with working experience working at top tier asset management, real estate, and venture firms such as Overlay Capital, Science, and Angelo Gordon. Strong data analytic and programming skills enabling performance and strong analytics across the platform. Crypto and digital asset experience. Specialties: Crypto |Venture Capital| Digital Assets| Raising Capital | Private Equity| Data Analytics. Will graduated from the University of Southern California with a Business Administration Major and Data Analytics Minor.

Jennifer Cuccaro

Advisor

Jennifer Cuccaro is COO and Head of Asset Management at Reformation Group, an Advisory and co-investment firm. With over 20 years of experience in financial services originating and overseeing investment portfolios and operating platforms in excess of $100BN for insurance and global alternative investment firms. Substantial experience identifying and executing private capital investments and establishing and launching new businesses and products. A regulatory expert and experienced board member, with an extensive network including corporates, financial institutions such as banks, insurers, asset managers, and governmental entities. Expert in structured credit and insurance protection solutions across a wide range of complex financial, products and exposures including, FinTech, Energy, ESG, Infrastructure, Project Finance, Utilities, Transportation, and Government.

Jennifer holds a BS from Carnegie Mellon and a MBA from the Kellogg School of Management.

Lane McDonald

Advisor

Lane is an execution-focused executive with over 20 years of experience devising and delivering measurable EBITDA impact and building strong, agile, delivery-focused teams from an executive, PE operating partner, board, or consulting role. She is the co-founder and managing partner of ESG Portfolio Partners, a boutique PE advisory firm specializing in EBITDA growth for PE-backed companies. Prior to ESG, Lane was the Chief of Business Operations for Ropes & Gray, a $2BN global professional services firm, and was the founding North American member of the Industry Value Creation team, serving as the Global Head of Financials & Business Services for Partners Group, a $120BN AUM private equity firm, where she was a voting member of the private equity, private debt, and global investment committees. She also held strategic operating roles at Delta Air Lines, American Express, JetBlue Airlines and Bain & Company.

Lane holds a BA from the University of North Carolina at Chapel Hill.

David Castain

Advisor

David Castain and Associates (DCA) transforms the world’s greatest and most promising brands into even greater and more promising brands. David has personally flown more than 14 times around the globe to 45 countries to thoroughly examine and reconstruct international techniques used in demographic marketing segmentation. DCA is known for their unorthodox and highly customized recommendations in achieving client objectives. With an ever-changing economy, we need ever changing and developing ideas. A traditional way of doing business falls short of the rapidly changing pace of social development. DCA is able to monitor these social changes, research the trends, and create a product that meets both the social and business expectations.

David graduated from Howard University

Eugene Caraus

Advisor

Eugene has worked in private debt markets and corporate finance for over 17 years. Most recently, he was a director at HIG Capital and executed over $30BN bespoke credit facilities including fund capital call lines, realty credit ABL repos, and TRS facilities with both U.S. and European banks. He helped grow the credit platform from $3.5BN to $17BN+, from 5 to 30+ funds by building out systems, teams, and developing banking relationships. Provided deal side and fund IRR models to forecast ABL SPV ramp-ups, liquidations, refinancing walls, and recapitalization amendments. Prior to HIG he was a VP at Cerberus Capital.

Eugene holds a BS In Finance from the Eastern Illinois University.

Shaun

Advisor

Shaun has over 25 years experience as a lawyer and business advisor, working for both the public and private sectors across Australia, the UK & Europe and now the Middle East. Shaun began his career in private practice at Ashursts and then Freshfields, and has spent the last 19 years in various in-house roles.

In 2016, Shaun moved to Saudi Arabia to work with Vision Invest (an infrastructure developer), and then as Vice President and Board Secretary at Miahona (a Vision Invest subsidiary focused on water utilities). He is now Group Chief Legal Officer for the BEEAH Group, which is a pioneer in the region for sustainability and digitalization across multiple sectors such as waste, transport, healthcare, digital, hydrogen, solar and real estate within the GCC. Shaun is highly regarded for his commercial acumen and skills as a transaction closer.

Recognized through various awards, he was most recently voted as General Counsel of the Year for 2024. Currently accredited as a certified director, he holds the positions of Chairman of the CLO Network UAE, Chairman of IPFA Middle East (the ‘International Project Finance Association’) and non-executive director on IPFA’s global board.